First Guaranty Bank encourages everyone to remain vigilant with their personal information. Change your passwords often, activate account alerts for bank accounts and credit cards, continue to monitor your credit report, and remain cautious when receiving phone calls/text messages/emails from unknown people. Remember, FGB will never call you to ask for personal or account information.

SecurLOCK

Get debit and credit card protection and peace of mind in the palm of your hand with FGB SecurLOCK. Download the free app that gives you the ultimate control! SecurLOCK is available for personal and business accounts.

- Misplaced your card? Lock it instantly for peace of mind.

- Shopping around the neighborhood? Set the card to work only where you are.

- Spending more responsibly? Receive real-time alerts and access your transaction history.

Download the SecurLOCK User Guides

Remember to be aware of the following scams:

- Phishing scams

- Being aware of your surroundings online can prevent you from falling victim to the fraudulent practice of perpetrators probing your personal emails and online forums inducing individuals to reveal personal information like passwords and credit card information. Never click links in an email or text messages you weren't expecting and look before you click. Remember, our URL is www.fgb.net.

- Fraudulent Mailers

- Scammers may use our name or variations of First Guaranty Bank to solicit your personal information regarding your mortgage. Mailers circulating are NOT from First Guaranty Bank. If you have questions about your mortgage, please call our Customer Support Center at 888-375-3093.

- Fraudulent Phone Calls

- Similar to fraudulent mailers, scammers may use our name (or variations of First Guaranty Bank) in the caller ID to solicit your personal information. Remember, we will never call you or text you to ask for personal or account information. If you receive a suspicious call, do not answer or call back. If you have questions about your account, please call our Customer Support Center at 888-375-3093.

How does First Guaranty Bank recognize fraud?

ATM/Debit Card Fraud Protection:

Our automated system will contact you in the following order: text message, email, and phone call, to verify suspicious card transactions.

NOTE: You will NEVER receive a text, call, or email from us asking you for your Debit Card number.

ACH Debit Block/Debit Filter:

Our ACH Debit Blocking services help protect your business against unauthorized ACH transactions by enabling you to specify which companies are authorized to post ACH debits, while automatically blocking all unauthorized electronic drafts or charges.

Benefits include:

- Monitors all ACH activity

- Protects your accounts from fraudulent or unauthorized ACH debit activity

- Enables you to maintain full control over your accounts while receiving external debits

- Eliminates possibility of unauthorized external debit entries posting to your account

![]()

External Transfers, Wires, and ACH Transactions:

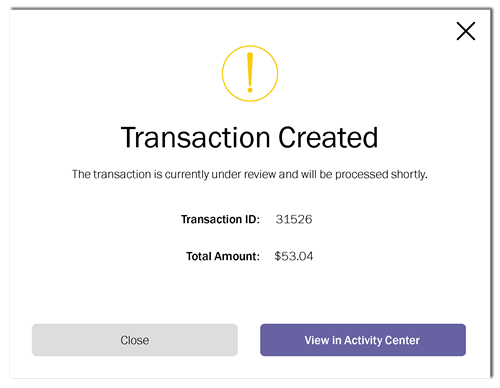

If an external transfer, ACH, or wire transaction appears abnormal, you will receive a notification within your online banking session. For your protection, any abnormal transaction will be placed on hold.

For security reasons, this transaction is on hold and under review. It will not be processed until the review has been completed. Expect a call from one of our FGB Representatives OR call us at (985) 348-0561. You can check for transaction status updates in online banking.

NOTE: You will still be able to access your account and use your debit/credit card. Only the abnormal transaction will be placed on hold. If the transaction occurs over the weekend, the transaction will remain on hold until the following business day when the transaction can be reviewed.

IDProtect:

IDProtect is one of the Club Benefits from our Active Club or Advantage Club Checking accounts. It helps better protect you and your joint account owners by monitoring possible identity theft incidents. This service1 includes credit file monitoring2, credit report and score3, monitoring of over 1,000 public databases, identity theft expense reimbursement4, fully managed resolution services, and more.

Positive Pay:

Positive Pay offers fraud protection service by providing a trouble-free way of monitoring checks clearing customer accounts and helps identify unauthorized transactions before final payment. Positive Pay is a feature that can be enabled for business customers that can help monitor accounts for unauthorized checks and/or ACH transactions. Customers must upload their issued check file or create ACH rules, which will cause exceptions to be created for review. Customers have the ability to decide whether to pay or return the items that are on the exception list. The deadline to make decisions on exceptions is 10 AM CST.FGB implemented Payee Match as part of our Check Positive Pay offering. Payee Match compares the payee on the check image against the payee’s name that is listed on the issued check file. Enabling Payee Match offers our customers an additional layer of protection by validating the payee in addition to the check number and check amount.

Other Resources

For more information and tips about protecting yourself from online fraud, read this blog. You can also check out our privacy policy here.

1 Benefits are available to personal checking account owner(s), and their joint account owners subject to the terms and conditions set forth in the Guide to Benefit and/or insurance documents for the applicable Benefits. Benefits are not available

to a “signer” on the account who is not an account owner or to businesses, clubs, trusts organizations and/or churches and their members,

or schools and their employees/students.

2 Credit file monitoring may take several days to begin following activation.

3 Credit Score is a VantageScore 3.0 based on single credit bureau data. Third parties may use a different VantageScore or a different type of credit score to assess your creditworthiness

4 Special Program Notes: The descriptions herein are summaries only and do not include all terms, conditions and exclusions of the Benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of

coverage and exclusions. Coverage is provided through the company named in the Guide to Benefit or on the certificate of insurance.

Insurance Products are not insured by the FDIC or any Federal Government Agency. Not a deposit of or guaranteed by the bank or any bank Affiliate.

.png?sfvrsn=ceb44cb1_1)